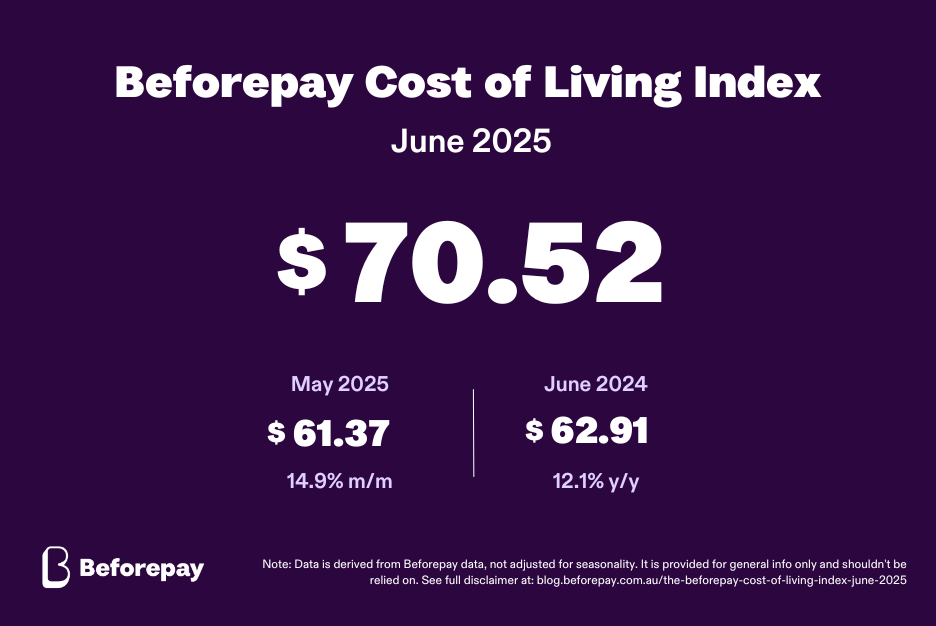

Sydney, Australia – The Beforepay Cost of Living Index rose 14.9% in June to a daily average spend of $70.52, marking the sharpest monthly increase recorded this year. While rising costs played a role, the standout driver was a 32.2% surge in durable shopping, as Australians appeared to take advantage of end-of-financial-year (EOFY) sales and tax-time spending opportunities. On a yearly basis, the Index rose 12.1% from $62.91 in June 2024.

Durable shopping—covering longer-term purchases like electronics, appliances, and furniture—reached a daily average spend of $9.24, its highest level in over a year. The timing suggests that many households may have been aligning higher-value purchases with EOFY promotions in June.

The Beforepay Cost of Living Index for June 2025 is $70.52.

“We saw a significant rise in durable spending in June, which likely reflects a mix of end-of-financial-year sales and planned purchases around tax time,” said Jamie Twiss, CEO of Beforepay. “It’s a reminder that even when people are being cautious, they’re still looking for the right moments to spend—and staying aware of those shifts can help them manage their budgets more confidently.”

Spending rose across all tracked categories, suggesting that June’s increase wasn’t limited to one-off purchases.

Utilities climbed 21% to a daily average of $8.52, continuing its rise into winter. Fitness and health (+17.6%) and general shopping (+15.6%) also moved higher, while spending on entertainment and leisure (+11.7%) picked up as households adjusted to seasonal routines.

Day-to-day essentials like food and drink (+10.4%), petrol and auto (+11.3%), and groceries (+8.4%) also saw steady increases—suggesting that the lift in spending extended across both planned and routine expenses.

The June Beforepay Cost of Living Index is drawn from real-time transaction data from over 440,000 users and tracks average daily spending across key household expense categories.

For more information contact mediaenquiries@beforepay.com.au.

Durable goods spending surged 32.2%, aligning with end of financial year sales in the lead-up to tax time.

About Beforepay Cost of Living Index

The Beforepay Cost of Living Index shows the average daily spend of Beforepay registered users across multiple household expense categories. As of March 2024, the average annual individual Beforepay customer gross income was $65,783 (counting only the main source of income) with a broadly representative geographic and gender breakdown. The data may vary depending on the main bank account linked with Beforepay. To the maximum extent permitted by law, Beforepay and its related bodies corporate, make no representation or warranty, express or implied, as to the accuracy, completeness, timeliness or reliability of the contents of this article and do not accept any liability for any loss whatsoever arising from the use of this article or its contents or otherwise arising in connection with it.

For more information about the Cost of Living Index visit the Beforepay website: https://blog.beforepay.com.au/tag/cost-of-living-index

About Beforepay

Beforepay Group is an ethical-lending fintech founded in 2019 to create safe and affordable lending products.

Beforepay Group operates two business lines: Carrington Labs, which builds and deploys AI-powered credit risk management solutions, and Beforepay, the Company’s direct-to-consumer business.

Beforepay's flagship pay advance product is a safe and affordable way for customers to access a portion of their pay, on demand, for a single fixed fee to help them through short-term cash-flow challenges.

The Beforepay app also includes free budgeting tools and spending insights.

For more information visit: www.beforepay.com.au